Harmoney exceeds loan origination prospectus forecasts with 47% growth in Q2 FY21 on Q1 FY21

ASX/NZX release

Harmoney exceeds loan origination prospectus forecasts with 47% growth in Q2 FY21 on Q1 FY21

Highlights

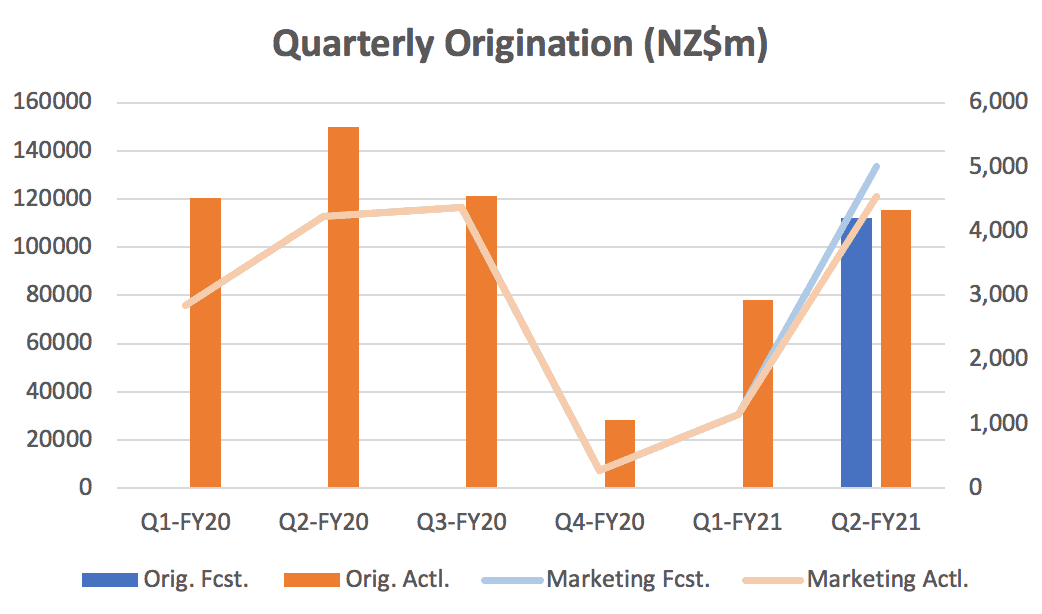

- Harmoney exceeded its loan origination Prospectus forecasts for the six months to December 2020 with strong quarter on quarter growth

- New Zealand loan origination increased by 44% in Q2 FY21 to NZ$89m, versus NZ$62m in Q1 FY21

- Australian loan origination increased by 69% to NZ$27m in Q2 FY21 versus NZ$16m in Q1 FY21

- Second New Zealand securitisation warehouse established with M&G Investments of up to NZ$200m is now operational, significantly reducing Harmoney’s cost of funds as it accelerates its transition from its legacy peer-to-peer funding model

- Harmoney has now originated over NZ$1.9 billion in personal loans across New Zealand and Australia, with a total current loan book of NZ$469m

Harmoney Corp Limited (ASX:HMY) (Harmoney or the Company), Australasia’s largest online direct personal lender, advises that it has exceeded its loan origination forecasts for the six months to 31 December 2020 (on an unaudited basis), delivering total loan originations of NZ$194m for the period, 2% ahead of Prospectus forecasts.

Commenting on the update, CEO and Managing Director, David Stevens, said:

“We are really excited with our loan origination momentum in the quarter ended 31 December 2020 (Q2 FY21). Our recent quarterly performance reflects a significant return to pre-COVID lending volumes, with 47% growth experienced in the December quarter across the Australian and New Zealand markets. This is a volume recovery which we expect to sustain into the second half, as consumers demand more agile, flexible and convenient online borrowing experiences.

Our strategy to limit new loan originations during the COVID-19 impacted period meant our loan growth slowed year-on-year. However, in line with the wider economic recovery, we have adjusted credit settings and ramped up marketing activity with a focus on attracting a strong pipeline of high quality borrowers in Australia and New Zealand. Our technology-based Stellare™ platform is delivering more aggressive growth in FY21, and is supported by the recent addition of our third warehouse facility.”

Operational update

In Q2 FY21, Harmoney’s New Zealand loan originations were 44% higher at NZ$89m, versus NZ$62m in Q1 FY21. In Australia, a market which Harmoney entered in 2017, loan origination increased by 69% to NZ$27m in Q2 FY21 versus NZ$16m in Q1 FY21.

Harmoney has now originated over NZ$1.9 billion in personal loans, serving more than 48,000 customers across New Zealand and Australia with a total current loan book of approximately NZ$469m as at 31 December 2020.

Harmoney’s loan portfolio continued to demonstrate strong credit performance with Group 61+ day arrears declining to 1.3% down from 1.6% as at 30 June 2020. 90+ day arrears also further declining to 0.58% down from 0.98% as at 30 June 2020.

Harmoney will update the market further with its audited H1 FY21 results for the half year ending 31 December 2020, scheduled for release on Wednesday 24 February 2021.

Diversified funding

Also during the last quarter, and as announced on 22 December 2020, Harmoney established its second NZ warehouse funding facility to be provided by M&G Investments of up to NZ$200 million. This facility, combined with Harmoney’s two other ‘Big Four’ bank warehouse facilities, provides total warehousing capacity of NZ$353m and AU$115m (NZ$476m total), while significantly reducing Harmoney’s funding costs.

As at 31 December 2020, Harmoney had NZ$264m of available funding headroom across its three warehouse facilities, providing strong capacity for growth.

ENDS

All numbers included in this release are preliminary and unaudited. This release was authorised by the Board of Harmoney Corp Limited.

For queries please contact:

Investors

David Stevens

CEO & Managing Director

investors@harmoney.co.nz

Media

Courtney Howe

+61 404 310 364

courtney@domestiqueconsulting.com.au

About Harmoney

Harmoney is an online direct personal lender that operates across New Zealand and Australia providing customers with unsecured personal loans that are easy to access, competitively priced (using risk-adjusted interest rates) and accessed 100% online.

Harmoney’s purpose is to help people achieve their goals through financial products that are fair, friendly, and simple to use.

Harmoney’s proprietary digital lending platform, Stellare™, facilitates its personalised loan product with applications processed and loans typically funded within 24 hours of acceptance by the customer. Stellare™ applies a customer’s individual circumstance to its data-driven, machine learning credit scorecard to deliver automated credit decisioning and accurate risk-based pricing.

Business fundamentals

- Harmoney provides unsecured personal loans of up to $70,000 for three, five or seven year periods to customers across New Zealand and Australia

- Its direct-to-consumer and automated loan approval system is underpinned by Harmoney’s scalable Stellare™ proprietary technology platform

- A significant percentage of Harmoney’s originations are “3R” (repeat) customers, with losses on repeat loans approximately 40% lower than first time loans

- Harmoney is comprised of a team of 69 full-time employees across Australia and New Zealand, over half of whom comprise engineering, data science and product professionals

- Harmoney is funded by a number of sources including two “Big-4” bank warehouse programs across Australia and New Zealand and a facility from M&G Investments